Base metals monthly outlook :

The September month remained positive for base metal complex with all metals traded near multi month high on rising euro against dollar coupled with improving macroeconomic fundamentals. Red metal the king of metals soared to 2 year high, crossing major mark of $8000 with dwindling stocks at major warehouse supported rally. Along with copper, other metals nickel, zinc and lead also took cues from macro economic outlook. Battery material lead gained by more than 10 percent while zinc prices settled with almost 8 percent gain with no major movements in stocks. LME Zinc prices sustained above $2200, and lead above $2300. While nickel remained the top performer, hovered near $24000 with 3 percent rise in LME stocks. Last month, rally in euro against US dollar was major supportive factor for base metals as from the chart we can see the rally occurred in euro and metals. Euro on monthly basis noted more than 7 percent rise while LME metal index gained by almost 10 percent.

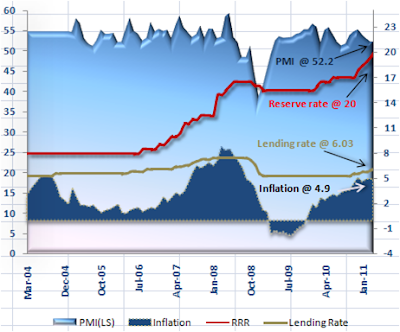

Major economic numbers from US, Europe and China painted fairly good picture with China’s PMI numbers boosted sentiments during month end. The Purchasing Managers Index of China's manufacturing sector rose to 53.8 per cent in September, up 2.1 percentage points from August. Euro zone manufacturing index also witnessed positive sign. While, US economy grew only slightly in the second quarter, confirming that the pace of the economic recovery had slowed.Gross domestic product rose at an annual rate of 1.7 per cent in the quarter against expectations of 1.6 percent, marking a sharp decline from the first quarter, when growth hit 3.7 per cent.

COPPER

Red metal, posted golden performance in last month with prices climbed to 26 month high, broke $8000 mark and settled with nearly 10 percent monthly gain with macroeconomic and fundamentals factors remained fairly positive for copper. In the third quarter, copper prices increased by more than 20 percent with dwindling stocks at major warehouses, LME stocks down almost 30 percent this year, supported trend. Major economic numbers from US, Europe and China painted fairly good picture with US GDP and China’s PMI numbers boosted sentiments during month end. Weakening dollar against major currencies added positive cues as dollar index noted nearly 5 percent downside. Shortage of supply from major mines will be the major cues in the coming quarter as demand from emerging countries and western countries are expected to improve.

If we look at the supply side, then structural story in copper is not demand but its supply, which adversely affected due to some factors. International Copper Study Group, reported copper market in to deficit of 2,81,000 tonnes in first half of 2010.

Consistent declines in warehouse inventories indicate improvement in physical demand as stocks are down by 30% from a 6 year high, seen in Feb-2010. Currently stocks are below 4,00,000 levels.

• The rate of production is declining at the world’s largest copper mine. As Escondida, BHP Billiton forecasts 5-10% cut this year due to lower ore grades. Rio Tinto and Free port McMoRan mines also showing output cut in first half of the year.

• Further, there is a potential for drop in production from Australia as a resulted of resources tax, the government might implement.

• In last year, US copper mine production had been expected to increase by more than 2,00,000 tonnes but production declined by 1,20,000 tonnes due to slowdown.

So, when we consider recent lack of exploration spending, increasing demand from developing countries, declining resources-ore grades, insufficient number of new fund deposits, labour problems like strike all are together resulting shortage in supply.

The fourth quarter is shaping to be more positive as the recovery is on the track. In other words the fear of double dip recession has gone away as micro and macro -economic figures from different countries including industrial number, manufacturing growth rate, etc, are coming with positive bias.

Emerging Nations demand for copper: Looking to macro factors, electricity generation figures also indicates economic growth as electricity consumption is highly correlated to manufacturing and industrial demand. Electricity production grew at an average annual rate of 14.3% from 2004-07 and at the same time China economy grew at 10.5% year. However in 2008 and mid 2009, electricity growth has decreased due to slowdown in economic growth but at the end of 2009 growth rate hit all time high. And during first 9 months of 2010, growth rate looks at higher levels. So, overall data signals growth in China. The electricity growth rate is expected to reach 15% in 2010 that would be consistent with 10% GDP rate.

According to International Energy Agency (IEA), India’s power production needs to rise by 15-20% annually. Because of investment into new infrastructure India’s annual copper demand is expected to more than double to near 1.5 million tonnes by 2012 up from current level of 6 lack tonnes.

According to Reuters calculations based on net imports, domestic production and stocks monitored by the Shanghai Futures Exchange, China, the world's top copper, aluminium and zinc consumer, apparently consumed 662,179 tonnes of refined copper in August up 22% from a year earlier and 3.3% from July. The latest Chinese copper import figures were strong with net refined copper imports climbing 19.6% m o m in August following a 6.1% m o m increase in July. Scrap imports were also 5.2% higher in August the third monthly increase in a row.

So, increasing demand of red metal in developing nations will be more than make up for decreased demand in Western world. And when western economies recover, they must, and then the supply squeeze will become even tighter.

One Month expected trading range for LME Copper would be $8600/t-$7400/t.

LEAD & ZINC

Battery material, Lead, the second worst performer LME after zinc has recovered strongly in the month of September, posted almost 10 percent gain with expecting good demand from battery sector. During the third quarter drawdown in warehouse stocks failed to boost sentiments but prospects of new capacity additions in China and rise in cancelled warrants stocks on LME indicating the prospects demand of lead in the coming quarter. In third quarter prices have recovered from lows of $1581/t and broke above $2300 in September.

With new capacity kicked in and existing operation ramped up in anticipation of peak up in demand in fourth quarter, Chinese refined lead production in August increased by 10.7% from a year ago to 4,00,400 tonnes, which increased 5 percent on mom basis. Keeping this matter into mind, total production this year is expected to exceed 4 million tonnes.

While on demand side, car sales, major consumption sector of lead, have been improving worldwide with Chinese car sales have been strengthening as in August car sales in china were 15.6m units on an annualized basis, which boosted its forecast for sales this year by 1m to a total of 16m units. So, the expecting growth sector in lead demand will be sufficient to soak up the expansion in Chinese lead production capacity. China’s exports of lead have been exceeded by their import which implies that domestic Chinese demand is very strong.

International Lead and Zinc Study group reported lead market in surplus by 52,000 tonnes in first seven months of the year where global refined lead use was 5.055 million tonnes compared with 4.894 million in same period last year. World refined lead output was 5.107 million tonnes, up from 4.976 million a year earlier.

Prices of Zinc have risen along with other metals despite of poor fundamentals as macroeconomic drivers remained somewhat positive with prices reached the healthy level of $2,200/t in last month, posted nearly 8 percent gain.

Looking to demand-supply statistics, china’s import zinc concentrate noted decline of 16% as China imported 1.7Mt of zinc concentrate in the first seven months of 2010 while sharp rise in production is noted with china produced 2.44 Mt in the first eight month of 2010 which is up 35% on same period last year. China’s imports of refined zinc in the first seven months to July were 0.177 Mt, down 67% on the year while refined production was 3.33 Mt in the year to August, up 24% year-on-year.

It is clear that in 2010, zinc market would be in a surplus however in 2011 and 2012 zinc concentrate market is expected to tighten as many major mines are near depletion or closure resulting not enough supply and this would affect refined supply, especially in China where power costs have risen and margins have already been squeezed, so sustained low treatment charges may force some smelter closures. Currently, China is relying more on domestic zinc mine supply to fuel its refined output, but to fulfill the additional smelter capacity due online in the next two years it will need to increase its imports of zinc concentrate.

The latest report released by International Lead and Zinc Study Group indicates that the global market for refined zinc metal was in surplus by 151000 tonnes in the first seven months of 2010. Over the same period stock levels reported by the LME, SHFE and producers and consumers increased by 194kt.

Global zinc mine output rose by 13.6%. This was primarily driven by increases in Australia, China, India, Mexico and Namibia. An increase in global refined zinc production of 16.2% was a consequence of higher output in a number of countries, most notably Belgium, Canada, China, India and the United States. Global demand for refined zinc metal rose by a significant 18.7%, largely driven by increases in China (12.9%) and rebounds in Europe (31.9%), Japan (31.8%).

Next Month expected trading range for LME Zinc would be $2350/t-$2075/t and Next Month expected trading range for LME Lead would be $2500/t-$2150/t.

NICKEL

Despite lower steel demand in third quarter and rising inventories nickel prices managed to trade with positive bias and posted more than 12 percent gain as prices have been largely macro driven with China’s strength more than offsetting concerns of US and Europe economic sluggishness. Three month nickel prices on LME increased by more than 12% with prices just near to $24000 level, while nickels stocks have rose by almost 3 percent.

According to leading analyst, the global nickel market will be deficit of about 85,000 tonnes this year and will return to a demand/supply balance from next year due to new capacity coming on stream. Miners around the world have started ramping up output of nickel, a main component in stainless steel, after cutting back during the depths of the global financial crisis. Lagging the rise in demand from stainless producers in Asia, nickel producers have been playing catch up bringing shelved mine and treatment facilities on stream delayed by the financial crisis.

Vale SA expects to return to full production at its nickel mine in Sudbury, Ontario, following a prolonged strike this year and last. The Brazilian miner also aims to start production at a mine in New Caledonia by the end of this year, while First Quantum Minerals Ltd. says it has started hiring for a mine in Australia. Together, those two mines could add close to 100,000 metric tons to global production, equal to roughly 7% of expected 2010 demand.

On demand side, focus should be more on emerging economies rather than western economies demand from Asian countries are improving amid short term supply squeeze will be major factors to determine prices. Demand has roared back this year, helping draw down nickel stockpiles at the London Metal Exchange by more than 25% since February.

With improving demand from those nations and expecting recession to end, major mines returned to full production. So, it is uncertain that nickel supply will grow much in the short term and also uncertain about demand outlook as it is not guaranteed that demand from the stainless steel sector will rebound in fourth quarter. Overall, demand barometer, LME inventories might be the best indicator for underlying fundamentals and currently they are neither bullish nor bearish. So, until a sustained movement in these stocks is seen we expect to nickel prices to follow the broader macro trend rather than fundamentals.

Next Month expected trading range for LME Nickel would be $22500/t-$25000/t.

With rising prices of base metals, somewhat correction might take place but it would be buying opportunity for long term as improving macroeconomic fundamentals coupled with supply crunch will be price determinant for base metals. Overall, particular copper looks good, while price movements of nickel depends upon stocks, meanwhile prices are expected to trade with positive bias. Technically and macro driven rally supported lead and zinc prices to trade higher. In the next month prices are expected to maintain their earlier gains.