Has the Red Metal turned Red?

Widespread expectations of copper to reach above $11,000 remained muted with sluggish spot market prices coupled with continuously tight credit environment and geopolitical tensions kept the sentiments brittle. The factors recently confusing the investor mind are inflation, geopolitical tensions and Japan's natural disaster. Chinese persistent watchdog on inflation and escalating unrest in Libya assisted bears to acquire the ground temporarily. Recently with the continuous effort to curb inflation, Chinese copper imports have witnessed a sharp decline turned copper cash market to discount form premium. However, vital economic indicators from the major economies saw some improvement, helping market to sustain higher.

Copper posted a golden performance in last year with prices climbed to all time high, broke $10,000 mark on LME, posting more than 30 percent gain in last year as macroeconomic and fundamentals factors remained positive, supported the prices. Due to Chinese restocking, stocks at major warehouses reported sharp decline with LME stocks dropped by 25 percent in the last year. Weaker dollar against the major currency also added positive cues. Further, shortage of supply from major mines and improving demand will be the major cues in the coming quarter as demand from emerging countries and western countries are expected to improve. From the following factors copper price will be determined?

Where will Copper go as Japan's Economy Rebuilds?

Japan, the world's third largest economy, has been hit hard by the 8.9 magnitude quake that struck the northeast coast of Japan, trigged a tsunami resulted power plants, oil refiners and ports to temporarily shut activities. The quake's aftermath is also being felt in the financial markets. If we look for copper, then domestic demand for copper as well as other base metals will drop for short time as Japan's manufacturing plants remain closed due to quake damage amid power supply disruptions, however in long term demand may expected to rise.

Global copper product supply could be affected on the closure of refineries and plants in Japan as Japan is the second buyer of copper ore after China and it supplies finished products to manufactures around the world. Mitsubishi Materials Corp, Japan's third largest copper producer has halted production in its Fukushima prefecture smelter. Japan was expected to produce 1.6 million tonnes of refined copper in 2011, about 7.6 percent of world output. Looking to consumption side, Japan has typically consumed around 5 percent of the world's copper however the percentage will certainly increase over the next few years as reconstruction begins and country's infrastructure and housing will rebuilt.

Once the natural crisis gets over reconstruction would take place and rebuilding effort will require Japan to purchase huge amounts of industrial metals as it would need copper to replace electrical power cables damaged by tsunami, Aluminium would be required for household appliances, Zinc for galvanized steel, Lead for battery consumption and nickel to make stainless steel for larger infrastructure.

Oil & Copper divergence: Is it Bearish for copper?

Recent price drop in copper is to be also attributed to geopolitical tensions as the unrest in North Africa and Middle East raised the fear of global recovery. Fear of oil supply kicked the crude oil prices raising the fear of inflation. Of course the oil price has risen and copper price has fallen both of these are not unrelated as the fear of rising oil prices will dampen the industrial growth and economic recovery which may depress the copper demand.

There is a short term adverse effect on copper due to rising oil prices which we called a sentiment effect. However in the long term if the unrest eventually spreads to Saudi Arabia and other nations then we will see much higher oil prices and more volatility. But the word 'sustained' is important as if crude prices are likely to sustain above $110 for the next six months or the year then we can see the impact on inflation and demand destruction.

Copper, China & Inflation

China, the world's largest copper consumer and its economy has greater impact on copper prices as China and the health of its economy directly influences what goes on in the copper market. Right now, the focus remains on inflation. Concerns that Chinese government is taming inflationary pressures means every credit tightening or interest rate increase is viewed as an impending slow down depressing prices. Any result in monetary policy directly affects the copper prices as metals prices are sensitive to even small percentage point moves in perceived changes.

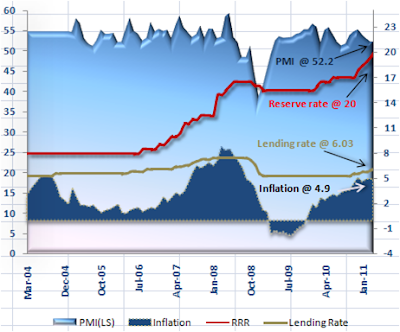

Chinese government has stated its preference to cap 2011 inflation at an average of 4 percent and it's so far from the current levels with current inflation rate stood at 4.9 percent against the previous level of 4.6 percent. To control the inflation, Chinese government has been rising interest rates in baby steps as China raised interest rates third time since October 2010 resulting one year lending rate to stood at 6.06% and deposit rate at 3.0 percent. The People's Bank of China also raised bank reserve requirements to record high at 20 percent. China has raised figures eight times by a total of 4 percentage points since January 2009. With every effort to tighten monetary policy could limit the economic growth and adversely affect the copper imports and demand for industrial metal. China producer manufacturing index remained under pressure with figures stood at 52.2 against the high level of 54.1 seen in December. The series of tightening measures by the central bank also had impact on loan growth as China's banks issued less than CNY600 billion, 91.3 billion in US dollar term, worth of new yuan loans in February, well below January's CNY1.04 trillion.

Supply Deficit - the only driver behind bull story

Analysts have already predicted supply shortage of copper for 2011 as there is no expectation of new supply this year however there is a potential for supply disruptions from aging mines. In 2010, copper has outperformed other base metals having posted a 30% returns. Considering the recent lack of exploration, increased demand from developing countries, declining resources like ore grades, insufficient number of new fund deposits , labor problems like strike and mine closure due to natural disaster all together resulted in shortage in supplies.

Many leading mines across the globe which were developed over two decades ago are yielding ore with less and less metal content resulting low percentage of productivity. The rate of production is declining at the world's largest copper mine as production at Escondida, the world's largest copper mine is anticipated to drop as much as 10 percent due to lower grades. Other mines like BHP Billiton and Rio tinto also suffered from production in last year. According to International Copper Study group, the refined copper market balance for the full year 2010 indicated a market deficit of about 305,000 metric tonnes compares to a surplus of 175,000 tonnes in 2009. Stronger than anticipated refined copper usage, which grew by 1.3 million tonnes (Mt), coupled with a smaller than anticipated growth in supply of 770,000 tonnes pushed the market into deficit.

In 2010, world usage of refined copper grew by around 7% to 19.4mt whereas the usage grew by 8% in Europe, 20% in Japan and 8% in US, although still usage rates are below pre crisis levels. In 2010, Chinese apparent usage increased by a more modest 4.3% from the very strong apparent usage growth of 37% in 2009, while world refined usage ex-China increased by around 8.5% in 2010. On a regional basis, usage increased in Africa by 1%, in Asia by 5.5%, in the Americas by 11%, and in Europe by 9%. Usage decreased in Oceania by 1%.

World mine production in 2010 increased by a modest 1% nearly 165,000t to 16.1 Mt and the average global mine capacity utilization rate fell to about 81% in 2010 and was at the lowest level in at least 20 years. Production in Chile, the biggest world producer, remained practically unchanged and was 2.6% below that in 2007. Output from other major producers such as Peru, the United States, Australia and Indonesia, that combined represent around 25% of total world copper mine production, decreased by an aggregated 5%.

Copper price: Inelastic to demand

There is a saying in commodities that high prices is the best cure for high price means when prices are high consumers will decrease consumption or substitute the other products, that's why, when prices of a metal rises to a certain point substitution becomes a factor. Substitution means end user may use another metals instead of copper. Substitution results in a decrease in demand which can help to correct prices. Copper primarily used in construction, cars, and electronics and for many applications there is no viable substitute, in economic term it is called a 'low elasticity of demand' or a 'demand inelastic'. That means high prices have a little influence on the quantity demanded, therefore the consumer will continue to purchase the commodity despite the high prices.

Emerging markets – the driving force behind the rally

Emerging nations demand for copper remained fairly positive as China and India are among the largest demand sources for industrial metals and responsible for copper consumption. Looking to macro factors, electricity generation figures also indicates economic growth as electricity consumption is highly correlated to manufacturing and industrial demand. According to International Energy Agency, India's power production needs to rise by 15-20% annually. Because of investment into new infrastructure India's annual copper demand is expected to more than double to near 1.5 million tonnes by 2012 up from current level of 6 lack tonnes. In 2011 China will continue to dominate global copper usage, which could rise more than 5%, and demand from western economies like from US and Europe will improve after facing a rescission period.

The annual per capita consumption of copper in India is 0.47 kg, China's 5.4 kg and the world average is 2.7 kg. China's urbanization plans and forecast GDP growth of 9.6 percent a year is expected to drive Chinese copper consumption from the current 5.4 kg/capita to an surprising 10 kg/capita by the end of the decade.

Now, question arises, where would be the copper this year, in the red or green zone? It would go lower or it's a buying opportunity? Simply, China's monetary policy will be the critical factor to determine the prices. Apart from it there are several supportive elements like increasing demand from the emerging nations will be more than make up for decreased demand from western world, and once the western economies recover, they would demand more and supply squeeze will become ever tighter. China and India being major growing economies supported the rally and will be supportive as consumption is further expected to increase. US economy recovery continues, not rapid but slow recovery, European nations may come out from recession while Japan would require more metals for reconstruction efforts after its earthquake and tsunami. Urbanization plan of China and India would also be benefited. Further year ahead supply is expected to be weak and likely to increase demand, thus increasing demand amid supply shortage can push copper price to reach record high, even above $11,000 in this year. In the short term there might be adverse reaction to the monetary tightening and MENA crisis but for the long term positive prices movement is expected.

Technically, LME 3 month copper price has strong support at $8700/t and $8000/t with resistance lies at $10200/t. For the short term, prices are expected to trade within the range of $8500/t and $10,000/t. For the next 2-3 months MCX copper price is expected to trade between Rs.380/kg to Rs.470/kg with buying on dips would be beneficial.